Posted inIncome Streams

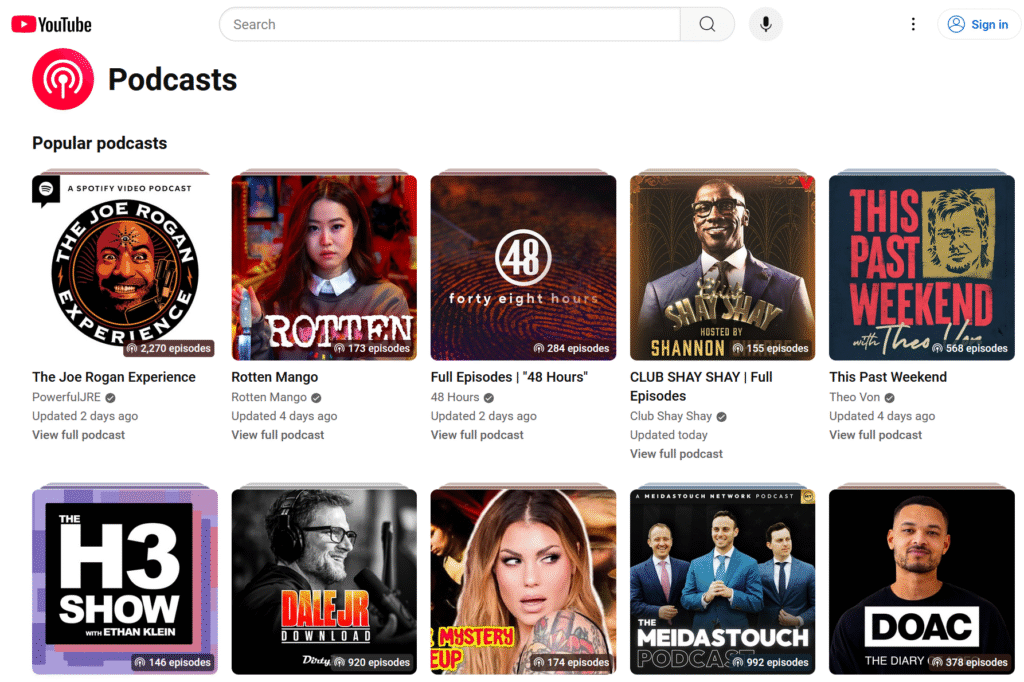

U.S. YouTube & Podcasting in 2025: A Monetization Boom

The creator economy has skyrocketed over the past decade. Today, U.S. influencers, educators, entertainers, and entrepreneurs leverage platforms like YouTube and podcasts to build diversified revenue streams. With evolving tools…