Historical Track Record: A Strong Foundation

- Since its inception in the 1920s and official launch as a 500-stock index in 1957, the S&P 500 has delivered an average nominal return of 9.8–9.96% per year, or roughly 6–6.7% after inflation

- Importantly, all historical 10-year rolling periods have been positive through December 2024—a powerful testament to its resilience over long horizons .

- Over shorter intervals, volatility can bite—33% of one-year periods saw negative returns—but that falls to just 12% over three years and 7% over five years .

2. Why Investors Call It “Safe” for Long-Term Growth

A. Diversification at Scale

- The S&P 500 captures roughly 80% of U.S. stock market capitalization, spread across 500 companies in 11 sectors

- This broad exposure helps mitigate company- or sector-specific risk.

B. Low Costs & Accessibility

- Low-cost ETFs like SPY, IVV, and VOO offer fee-efficient, transparent exposure with no lockups or performance fees—a proven advantage even versus private equity

C. Compounding & Dividends

- Dividends form a meaningful portion of long-term returns, accelerating compounding and smoothing returns during down cycles .

D. Discipline Over Timing

- Experts emphasize time in market, not timing the market. Dollar-cost averaging reduces volatility’s impact, especially for long-term investors

3. Current Market Context (Mid‑2025): Opportunities & Headwinds

SPDR S&P 500 ETF Trust (SPY)

$623.62

-$2.21(-0.35%)Today

$621.23-$2.39(-0.38%)Pre-Market1D5D1M6MYTD1Y5Ymax

A. Valuation Elevated but Earnings Still Key

- After an early 2025 dip tied to tariff disruptions, the S&P 500 rebounded sharply to record highs (~6,280 by July 10, 2025)

- However, current forward P/E ratios are near cycle highs, similar to those in 2021, raising concerns about valuation stretch

- Analysts await corporate earnings to justify further gains—tariffs remain a wildcard that could compress margins or fuel inflation .

B. Improved Momentum but Watch for Mean Reversion

- A 25% rally in 50 trading days post-April has historically seen further gains in most cases: average gains of 6.4% over 3 months, 10.5% over 6, and 16.4% over a year in similar past rallies

- But some experts warn the index may be 30–40% overvalued, undermining key assumptions of high returns for large-cap U.S. stocks

- Vanguard also forecasts nominal returns of just 2.5%–4.5% annually for large-cap U.S. equities through 2034—real return possibly negative after inflation

- While forward returns may be muted, positive outcomes remain likely for long-term holders who remain diversified across asset classes and geographies.

C. Concentration Risk Rising

- The “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, Tesla) now account for about 40% of S&P 500 market cap, raising concerns about index concentration and correlated drawdowns

- Some advisors recommend allocating a portion to small-cap value or international equities to rebalance risk-return expectations

4. Is the S&P 500 Still the Safest Long-Term U.S. Investment?

✅ Pros

- Historically consistent growth: Nearly universally positive 10-year returns, averaging 6–7% real annually .

- Transparent, low-cost vehicles with high liquidity and ease for retail investors (e.g. SPY, VOO, IVV) .

- Diversified exposure, including dividends, sectors, and companies.

- Resilience through crises: Recoveries after downturns like dot-com bust, financial crisis, and COVID show long-term durability .

❗ Cons

- Elevated valuations may suppress future expected returns, per Vanguard and others forecasting subdued decade ahead .

- Concentration in mega-cap tech poses risks if these firms stumble or macro dynamics shift .

- Macro risk from tariffs, inflation, interest rates, and geopolitical tensions may cause volatility and earnings pressure .

5. How Should Investors Position Their Portfolios?

A. Core Allocation to S&P 500

- Maintain a baseline allocation (e.g. 60%) in a low-cost S&P 500 ETF or index fund for stable, long-term equity exposure.

B. Diversify Beyond Mega-Caps

- Allocate some capital to small-cap and value stocks, which historically outperform on a long-term basis and offer upside beyond mega-cap-heavy indexes .

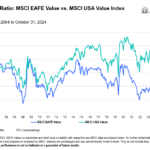

- Consider international equities, especially developed or emerging markets, to offset U.S. valuation concentration risks .

C. Use Timing Tools, Not Market Timing

- Rather than evacuating, base decisions on metrics like the 200-day moving average, VIX volatility, RSI momentum, plus valuation indicators like CAPE ratios .

- Avoid emotional responses; rebalance instead of redeem during volatility

D. Take a Long-Term View

- Investors holding for 10+ years historically face virtually no loss periods and benefit from cumulative compounding despite short-term noise

6. The Bottom Line

The S&P 500 remains one of the safest and most reliable long-term U.S. investment vehicles—offering broad diversification, decades of positive returns, liquidity, and low fees. However, with today’s elevated valuations, geopolitical uncertainty, and mega-cap concentration, its forward-looking return expectations may be more muted than historical averages.

Savvy investors often anchor their portfolios with the S&P 500 but diversify across smaller U.S. stocks, value strategies, and non-U.S. equities to balance risk and bolster return potential. Staying invested, disciplined, and diversified remains key—as does resisting the urge to abandon market equity in turbulent times.

For most buyers with a long time horizon, the S&P 500 continues to serve as the solid core for building wealth—but it’s rarely the only piece of a prudent investment plan.

📌 Key Takeaways

Is the S&P 500 Still the Safest Long-Term U.S. Investment?

- The S&P 500 has delivered ~10% nominal return (~6–7% real) over decades—a testament to long-term investment power.

- All rolling 10-year periods have been positive, and short-term losses are common but often reversed with time.

- Valuations are now high, with concentration in a few mega-cap firms and risks tied to tariffs and inflation.

- Diversification matters: small-cap value and international exposure can help offset potential downside.

- For investors with 10+ year horizons, time in the market—not market timing—is what delivers.