As the U.S. economy faces a period of transformation driven by technological advancement, shifting demographics, and geopolitical changes, the need for a robust “Growth Watch” strategy has never been more critical. Whether you’re an investor, business leader, or simply a concerned citizen, understanding where the next wave of growth will originate can help you future-proof your finances, career, or portfolio.

In this article, we dive deep into what “Growth Watch” really means, the sectors poised for long-term expansion, key economic signals to monitor, and how to position yourself to benefit from the upcoming decade’s most powerful growth drivers.

What Is “Growth Watch”?

“Growth Watch” is a proactive strategy of identifying and analyzing current and emerging trends that signal economic or industry-specific growth. It involves:

- Tracking macroeconomic indicators

- Monitoring innovation and emerging technologies

- Watching for demographic shifts and consumer behavior changes

- Analyzing regulatory and policy changes

- Staying ahead of geopolitical developments

This form of vigilance helps individuals and businesses make strategic decisions — whether that’s entering new markets, diversifying investments, or upskilling for future jobs.

1. Macroeconomic Signals to Monitor in the U.S.

Before diving into specific industries, it’s crucial to keep an eye on key macroeconomic indicators that reflect the broader health of the economy:

a. GDP Growth Rate

The GDP remains the gold standard for tracking overall economic expansion. As of mid-2025, the U.S. GDP growth hovers around 2.1%, a moderate rate that shows resilience despite inflationary pressures.

b. Labor Market Trends

A healthy labor market signals business confidence. Watch sectors with job growth outpacing the national average. Healthcare, clean energy, and cybersecurity are prime examples.

c. Inflation and Interest Rates

With the Federal Reserve cautiously adjusting interest rates to control inflation without hurting growth, the direction of monetary policy can open or close doors in sectors like real estate, banking, and consumer spending.

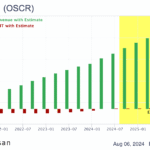

d. Corporate Earnings Reports

Monitoring quarterly earnings helps track sectoral trends. Big Tech, pharmaceuticals, and defense companies have shown consistent earnings strength post-2023.

2. The Fastest Growing U.S. Sectors (2025–2030)

Based on current data, the following sectors are poised for exponential growth over the next 5–10 years:

a. Artificial Intelligence & Automation

- Annual Growth Rate: ~37%

- Major Players: Nvidia, Microsoft, Palantir, OpenAI partners

- Opportunities: AI model training, enterprise AI services, robotics

AI is not just a buzzword anymore — it’s being actively integrated into healthcare, finance, law, and education. The rise of AI assistants, autonomous logistics, and personalized medicine are opening up new multi-billion dollar markets.

b. Clean Energy and Electrification

- Annual Growth Rate: ~20%

- Major Players: Tesla, Enphase Energy, NextEra Energy

- Drivers: ESG investing, tax incentives, global net-zero pledges

Federal and state incentives under the Inflation Reduction Act are propelling investment in solar, wind, EV infrastructure, and battery storage. Watch this space for both startups and blue-chip innovators.

c. Biotechnology & Genomics

- Annual Growth Rate: ~15–18%

- Major Players: CRISPR Therapeutics, Moderna, Illumina

- Focus Areas: Gene editing, personalized medicine, longevity science

The biotech boom isn’t over. Advances in mRNA, CRISPR, and AI-driven drug discovery are transforming how we treat cancer, autoimmune diseases, and neurological conditions.

d. Cybersecurity

- Annual Growth Rate: ~13%

- Major Players: CrowdStrike, Palo Alto Networks, SentinelOne

- Why It Matters: Rising cyberattacks, AI threats, hybrid work vulnerabilities

With the rise in ransomware and data breaches, especially targeting U.S. infrastructure and corporations, cybersecurity is no longer optional — it’s essential.

e. Digital Infrastructure & Cloud Computing

- Annual Growth Rate: ~17%

- Key Players: AWS (Amazon), Microsoft Azure, Oracle, Snowflake

- Growth Drivers: Data explosion, SaaS tools, AI-hosting demand

Everything is moving to the cloud, and edge computing is expanding capabilities in remote environments, from agriculture to battlefield command.

3. U.S. Regions to Watch for Growth

While Silicon Valley and New York remain key innovation hubs, other regions are emerging as growth hotspots:

a. Austin, Texas

- Known for: Tech migration, venture capital

- Top sectors: AI, semiconductors, real estate

b. Raleigh-Durham, North Carolina

- Known for: Research Triangle

- Top sectors: Biotech, education, healthcare

c. Phoenix, Arizona

- Known for: Solar power, semiconductor manufacturing

- Top sectors: Clean energy, logistics

d. Miami, Florida

- Known for: FinTech and crypto-friendly regulation

- Top sectors: Financial services, tourism-tech, Latin America expansion

e. Denver, Colorado

- Known for: Young, educated workforce

- Top sectors: Aerospace, healthtech, clean energy

4. Investment Strategies Aligned with Growth Watch

Growth Watch isn’t just about knowing what’s growing — it’s about acting on it intelligently.

a. Diversify with Thematic ETFs

Examples:

- BOTZ: Robotics and AI

- ICLN: Clean energy

- ARKG: Genomics and biotech

- HACK: Cybersecurity

These ETFs provide exposure to future-forward sectors with less risk than individual stocks.

b. Dollar-Cost Averaging in Growth Stocks

Invest regularly in high-conviction growth stocks (think Tesla, Nvidia, Palantir), especially during market dips. Over time, this smooths out market volatility.

c. Alternative Investments

- Venture Capital & Private Equity: Access high-growth startups.

- Real Estate: Invest in high-demand regions (Austin, Raleigh).

- REITs: Focus on data centers, logistics, and healthcare facilities.

d. Build a “Skills Portfolio”

Growth isn’t just about money — it’s about human capital. Invest in your skills in:

- AI & data analysis

- Digital marketing

- Blockchain development

- Healthcare certifications

These will remain in demand even in automation-heavy futures.

5. The Role of Government and Policy in U.S. Growth

Public policy plays a significant role in shaping economic growth. Some legislative factors to keep on your Growth Watch radar include:

a. Infrastructure Investment and Jobs Act (IIJA)

- $1.2 trillion toward roads, bridges, clean water, internet

- Long-term boom for construction, logistics, broadband infrastructure

b. CHIPS and Science Act

- $280 billion investment in U.S. semiconductor manufacturing

- Major boost to national security and tech independence

c. Inflation Reduction Act

- Largest U.S. investment in climate and energy in history

- Incentives for clean energy, EVs, battery production

These policies aren’t just theoretical — they’re actively reshaping America’s industrial and innovation landscape.

6. Key Risks to Watch

Not all growth paths are guaranteed. Some potential obstacles include:

a. Geopolitical Tensions

- China–Taiwan uncertainty

- Ukraine conflict

- Middle East instability

b. Overvaluation in Certain Sectors

- AI hype could cause temporary bubbles

- Caution against FOMO-driven investing

c. Economic Hard Landing

- If the Fed overtightens, it could tip the U.S. into recession

- Watch consumer sentiment and retail sales as indicators

d. Regulatory Crackdowns

- Tech monopolies face increasing antitrust scrutiny

- Crypto faces unclear regulation, leading to investor caution

7. Long-Term Outlook: The Next 10 Years

While it’s impossible to predict the exact trajectory of the U.S. economy, here are some megatrends to anchor your Growth Watch framework:

- AI-Powered Economy: From personal productivity to industrial automation

- Green America: The country is pivoting to net-zero emissions

- Healthcare Renaissance: Personalized, preventative, and digital

- Digital-First Society: Remote work, e-commerce, virtual services

- National Reindustrialization: Onshoring of critical manufacturing

These aren’t fads — they are structural shifts, and early movers will capture the lion’s share of the value.

Final Thoughts

The U.S. economy is entering a new era marked by innovation, sustainability, and transformation. “Growth Watch” is your compass in this landscape — a way to continuously track the trends, assess the risks, and make forward-looking decisions.

Whether you’re managing a portfolio, running a business, or planning your career path, your ability to identify and act on growth signals can define your success in the years ahead.

So keep your eyes open, your strategies flexible, and your mindset future-ready — because the next big growth wave is already forming.