1. Why Rental Properties Still Appeal in 2025

🔸 Structural Supply Shortage & Demographics

The U.S. faces an estimated housing shortage of 5–6 million units, driven by underconstruction, zoning restrictions, and skilled labor shortages. Demand is further boosted by millennials and Gen Z—many delaying homeownership or entering rental markets for the first time. These trends are projected to sustain demand through 2030 and beyond

🔸 High Rent Fundamentals

In many markets, renting remains more affordable than buying. With high mortgage rates—often exceeding 6%—and limited inventory, owning a home remains out of reach. As a result, rental rates continue to grow, especially in Sunbelt and secondary metros

2. Market Performance Outlook & Regional Trends

📈 Strong Rent Growth & Absorption

National rent growth is projected at 3–4% in 2025, slightly above core inflation, while top-performing markets like Tampa, Charlotte, and Salt Lake City may see 5–6% increases Sunbelt metros retain momentum, offsetting softness in high-cost coastal regions.

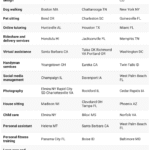

🌆 Hot Secondary & Sunbelt Cities

Top-performing affordability and demand markets include Austin, Phoenix, Nashville, Raleigh, Tampa, Atlanta, Orlando, and Charlotte. These cities boast strong rental yields—often between 5.5–6.8% on average—and low vacancy rates (<5%) thanks to population growth and steady job creation

🏢 Multifamily Resilience

Multifamily rentals remain resilient. Migration to Sunbelt and secondary markets strengthens demand. However, coastal markets like San Francisco and NYC show slower growth—or stall out—but still retain stable long-term fundamentals .

3. Investor Sentiment & Market Dynamics

🤝 Strong Investor Intent

Surveys show 76% of single-family investors plan acquisitions in 2025, while 87% expect solid rental demand to continue. A majority foresee positive home price appreciation, reinforcing confidence in housing economics

📊 Cap Rate Trends & Financing Costs

Cap rates are expected to widen by ~25 bps early in 2025 but could compress once rate cuts arrive. Value-add deals in the Midwest may yield attractive entry points (~7% cap rates) with upside through renovations and repositioning Meanwhile, mortgage rates are anticipated to hover around 6% through 2025, slowing though potentially dropping later in the year .

4. Income Potential & Tax Benefits

💵 Reliable Passive Income & Inflation Hedge

Rental properties generate consistent monthly cash flow, which typically rises with inflation. The combination of rental yield and appreciation helps build long-term wealth while resisting inflation erosion

🧾 Tax Advantages

Investors benefit from deductions—mortgage interest, depreciation, repairs, and operating expenses—and tools like 1031 exchanges to defer capital gains when rolling into new properties

5. Risks & Challenges to Consider

❗ Rising Operating Expenses & Tenant Regulation

Landlords are facing sharply rising costs—property taxes, insurance, repairs, maintenance—often exceeding 20% in 2024. At least 60% cite property tax hikes, and many increase rents accordingly to maintain profits .

Tenant protection laws and rent control policies are expanding in some jurisdictions, potentially compressing returns or complicating evictions and rent adjustments .

🌪️ Climate Risk & Insurability

Climate exposure is reshaping investment decisions. Coastal areas prone to hurricanes, flooding, or wildfires face rising insurance costs or shrinking coverage options. Investors are increasingly factoring resilience and geographic risk into their asset selection

🛠️ Vacancy & Maintenance Overheads

A vacant property costs landlords 8–10× more per day than a standard concession. Turnover and deferred maintenance disproportionately hurt net income and require active, hands-on management

6. Investment Strategies for Current Market

🧱 Core vs. Satellite Approach

- Core holdings: Northeast or Sunbelt multifamily units with stable cash flow

- Satellite picks: Value-add, build-to-rent, or short-term rentals in high-growth secondary markets

🏗️ Build-to-Rent (BTR) & Single-Family Rentals

BTR communities offer average stabilized yields of 6.8–7.5%, blending development upside with rental income. Single-family rental homes remain popular, supported by platforms such as Roofstock that simplify acquisition and management

🏙️ Mixed-Use & Amenity‑Driven Properties

Investments in mixed-use developments and sustainable green-certified units attract premium rents, diversified tenant bases, and longer tenant retention. These properties align with evolving tenant preferences and lifestyle expectations

🧠 Tech-Enhanced Property Management

AI-driven tenant screening, virtual tours, smart-home integrations, and dynamic pricing tools increase operational efficiency, reduce downtime, and help maintain NOI margin amid rising operational costs

7. Modeling a Rental Income Investment

Consider a rental property purchased for $300K with a 6% yield (~$18K gross rent/year). After expenses and vacancy, net income may land near $13–14K (≈4.5%). Over time, rent and property appreciation may grow at 3–4% annually, compounding both income and principal value while offering tax deductions.

Typical mid-sized value-add deals in secondary markets yield potential IRRs of 15–18% net—especially when factoring in renovation upside and tax-deferred strategies like 1031 exchanges

8. Should You Invest in Rental Properties Now?

✅ The Pros

- Persistent demand and limited supply underpin rental growth.

- Rental income offers reliable, inflation-resistant cash flow.

- Attractive tax benefits and appreciation potential.

- Ability to diversify geographically and by property type.

⚠️ The Cons

- High entry costs due to elevated interest rates and property prices.

- Rising operating costs and complex tenant regulations.

- Climate exposure imposing additional risk and insurance burdens.

- Illiquidity and active management requirements.

✅ Final Verdict: Reliable—but Requires Selectivity & Discipline

Yes—Rental properties remain a viable and generative income source in 2025, especially in growth metros, Sunbelt cities, and secondary markets where demand outpaces supply. But success requires:

- Market selection: Prioritize cities like Tampa, Orlando, Atlanta, Austin, Nashville based on demographics, job growth, and yield potential.

- Cost control: Manage insurance, maintenance, and regulatory overhead.

- Asset differentiation: Opt for green-certified, mixed-use, or tech-forward properties.

- Risk mitigation: Diversify property types—single-family, multifamily, build-to-rent, and mixed-use.

- Liquidity strategy: Have exit plans, leverage grants/tax tools like 1031, and evaluate platforms like Roofstock for turnkey investing.

By combining location discipline, hands-on oversight, and modern technology tools, investors can still count on rental real estate as a reliable, long-term income stream in 2025 and beyond.

📌 Key Takeaways

- Rental property demand remains robust in the face of high mortgage rates and tight supply.

- Top markets in 2025 include Sunbelt and secondary cities: Austin, Phoenix, Tampa, Orlando, Chattanooga.

- Rental yields in the 5–7% range are attainable, alongside mid-teen IRRs for value-add and BTR investments.

- Rising costs, regulation, and climate risk require careful selection and management.

- Sustainable, mixed-use, and tech-enabled properties offer a competitive edge.

- Investment should be strategic, diversified, and mindful of location-specific risks.