The U.S. hedge fund industry is one of the most dynamic, secretive, and strategically advanced sectors of the global financial market. With trillions of dollars in assets under management (AUM), hedge funds are known for aggressive trading, sophisticated instruments, and high-stakes alpha generation. Yet beneath this risk-taking reputation lies a sophisticated system of risk control strategies that allow these funds to operate at the edge of opportunity without falling off the cliff of financial disaster.

In this blog, we’ll explore how hedge funds in the U.S. approach risk control, what tools and strategies they use, how they differ from traditional investment managers, and what retail investors can learn from their institutional discipline.

What Makes Hedge Funds Different?

Unlike mutual funds or ETFs, hedge funds:

- Have more flexible mandates

- Use leverage, short-selling, and derivatives

- Are lightly regulated (especially for accredited investors)

- Charge performance-based fees (commonly 2% management + 20% profit)

These traits give hedge funds a broader toolkit to seek returns in any market condition, but also expose them to higher risks. Thus, risk control isn’t optional—it’s mission-critical.

Core Risk Control Principles in Hedge Funds

1. Capital Preservation First

Despite the popular belief that hedge funds only chase returns, most funds adopt a “survive to thrive” mentality. Their first job is not to make money—it’s to not lose money.

2. Risk-Adjusted Returns

Alpha is only meaningful when measured against the amount of risk taken to achieve it. Hedge funds obsess over metrics like:

- Sharpe Ratio (return per unit of risk)

- Sortino Ratio (focuses on downside risk)

- Maximum Drawdown (worst portfolio loss)

- Volatility (price movement deviation)

3. Tail Risk Awareness

Hedge funds prepare for rare but devastating events—like 2008 or 2020 COVID crashes—by hedging against tail risk scenarios.

Types of Risk Hedge Funds Manage

Hedge funds analyze risk across multiple dimensions:

| Risk Type | Description |

|---|---|

| Market Risk | Price fluctuations in stocks, bonds, currencies, etc. |

| Liquidity Risk | Inability to sell positions quickly at fair value |

| Credit Risk | Counterparty default in derivatives or debt |

| Leverage Risk | Amplified losses from borrowed capital |

| Operational Risk | Failures in systems, human error, fraud |

| Geopolitical Risk | Macroeconomic instability from war, policy, etc. |

Major Risk Control Strategies Used by Hedge Funds

Let’s dive into the actual strategies and tools used in the U.S. hedge fund industry to mitigate and manage risk effectively.

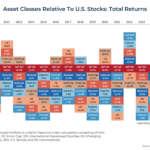

1. Diversification Across Multiple Dimensions

Hedge funds rarely bet the house on one asset or trade.

They diversify across:

- Asset classes (equities, bonds, commodities, currencies)

- Geographies (U.S., Europe, Asia, EM)

- Strategies (long/short equity, macro, event-driven)

- Time horizons (short-term trades vs. long-term positions)

Diversification helps reduce unsystematic risk—the kind that comes from being too concentrated in one area.

2. Position Sizing and Exposure Limits

No matter how strong a trade looks, hedge funds limit the size of each position to manage potential losses.

Example:

A long/short equity fund may limit a single stock to 5% of the portfolio and total sector exposure to 20%.

They also track:

- Gross exposure: Sum of long and short positions

- Net exposure: Difference between long and short positions

Net exposure helps gauge directional market risk.

3. Stress Testing and Scenario Analysis

Hedge funds simulate portfolio performance in extreme market conditions—past and hypothetical.

Stress Test Examples:

- 2008 financial crisis replay

- 2020 pandemic crash

- 5% interest rate spike

- 20% drop in Nasdaq

Using platforms like BlackRock Aladdin or Bloomberg PORT, they evaluate how their strategies hold up under pressure.

4. Dynamic Hedging with Derivatives

Derivatives are not just speculation tools—they’re essential for risk control.

Common Hedging Techniques:

- Put options: Limit downside on equity holdings

- Futures contracts: Lock in prices or short markets

- Credit default swaps (CDS): Insure against credit risk

- Interest rate swaps: Protect against rate fluctuations

Example:

A macro hedge fund betting on European growth may hedge with U.S. bond futures or currency swaps in case of dollar volatility.

5. VaR (Value at Risk) Models

VaR calculates the maximum expected loss of a portfolio over a given time with a certain confidence level.

Example:

“99% VaR of $1 million over 1 day” means there’s a 1% chance the fund will lose more than $1M in a day.

Limitations:

VaR doesn’t capture “Black Swan” events. Hence, hedge funds also look at Conditional VaR (CVaR) and tail risk.

6. Leverage Monitoring

Hedge funds use borrowed capital (leverage) to amplify returns—but it also magnifies risk.

How They Manage It:

- Limit leverage ratios (e.g., 3:1 max)

- Margin calls and collateral requirements

- Daily or real-time leverage tracking

Over-leveraging was the downfall of Long-Term Capital Management (LTCM) in 1998—a textbook case for today’s funds.

7. Real-Time Risk Dashboards

Top hedge funds use real-time dashboards to monitor:

- PnL (Profit & Loss)

- Exposures by sector/geography

- Volatility indexes (VIX, MOVE)

- Liquidity of positions

- Counterparty risk

Platforms used:

- Bloomberg Terminal

- BlackRock Aladdin

- Point72 Cubist systems

- QuantConnect & TradeStation (for quant funds)

8. Internal Risk Committees & Compliance

Larger hedge funds have independent risk teams or Chief Risk Officers (CROs) who operate separately from portfolio managers.

Responsibilities:

- Approve or reject trades exceeding risk limits

- Conduct daily exposure reviews

- Report compliance violations to regulators (e.g., SEC)

This separation ensures that decisions aren’t just about returns—but also about resilience.

Real-World Examples of Hedge Fund Risk Control

Bridgewater Associates (Ray Dalio)

- Uses Risk Parity: balances assets based on risk contribution, not just capital

- Avoids over-concentration in any one economic scenario

- Deep scenario modeling and macro hedging

Citadel (Ken Griffin)

- Runs multi-strategy portfolios with strict exposure caps

- Uses proprietary software for real-time risk analytics

- Allocates capital dynamically based on market volatility

Renaissance Technologies

- Quant-driven models tested with historical and synthetic data

- Uses short holding periods to minimize prolonged exposure

- Constantly adjusts based on algorithmic feedback loops

Risk Tools Commonly Used by Hedge Funds

| Tool/Platform | Function |

|---|---|

| Aladdin by BlackRock | Enterprise risk analytics |

| Bloomberg Terminal | Market data, VaR, scenario testing |

| Numerai Signals | Crowdsourced quant strategies with risk control layers |

| Point72 Cubist | Internal analytics & exposure dashboards |

| Python & R | Custom risk algorithms and data science models |

| RiskMetrics (J.P. Morgan) | Industry-standard VaR tools |

What Retail Investors Can Learn

You don’t need a $1 billion fund to control risk like the pros. Here’s how individuals can apply hedge fund principles:

| Hedge Fund Practice | Retail Equivalent |

|---|---|

| Diversification | Use ETFs across sectors |

| Derivatives | Use protective puts or covered calls |

| VaR analysis | Use Riskalyze or Personal Capital |

| Real-time tracking | Use apps like Delta or Morningstar |

| Scenario testing | Simulate portfolios with Wealthfront |

Most importantly: adopt the mindset of discipline over emotion.

Famous Hedge Fund Risk Failures

Long-Term Capital Management (1998)

- Over-leveraged and under-diversified

- Massive losses from Russian bond default

Archegos Capital (2021)

- Used total return swaps to conceal leverage

- Triggered $10B+ losses across prime brokers

Lesson: Even smart investors fail without transparency, liquidity, and leverage control.

Final Thoughts: Risk Control = Survival and Success

In the high-risk, high-reward game of hedge fund investing, risk control isn’t a background function—it’s the core engine. Without it, even the best ideas can become catastrophic failures.

As financial markets grow more complex, volatile, and AI-driven in 2025, hedge funds are not just chasing alpha—they’re building systems that keep them alive and thriving, even in the stormiest weather.

Retail and institutional investors alike would do well to adopt their best practices: be systematic, be diversified, respect leverage, and above all—never stop measuring your risk.

Stay Updated with WealthInStock.us

For more insights into U.S. investing, hedge fund strategies, risk management, and portfolio trends—bookmark WealthInStock.us and grow smarter every day.