In 2025, the United States economy is evolving at lightning speed. Emerging technologies, shifting consumer behavior, changing government policies, and the aftermath of global disruptions have created a dynamic environment where certain industries are growing exponentially. For investors, entrepreneurs, and professionals, identifying these high-growth sectors early can provide a massive advantage.

In this detailed edition of Growth Watch, we explore the fastest growing U.S. industries to watch in 2025—what’s driving their growth, key players, trends to follow, and why they matter more than ever.

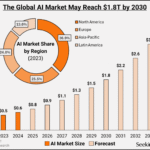

1. Artificial Intelligence (AI) and Machine Learning

No industry has captured the imagination—and wallets—of the business world in 2025 like Artificial Intelligence. From generative models to predictive analytics and robotics, AI is transforming every sector it touches.

Why It’s Growing:

- Accelerated enterprise adoption

- AI integration in healthcare, finance, education, and logistics

- Surge in AI-powered consumer applications

Key Trends:

- Generative AI (text, image, video creation)

- Edge AI for IoT devices and autonomous systems

- AI as a Service (AIaaS) platforms

Major Players:

- Nvidia, OpenAI, Anthropic, Palantir, Microsoft

- Startups specializing in AI-powered productivity tools and data analysis

Job Outlook:

- Huge demand for AI engineers, data scientists, AI product managers, and ethical AI consultants

2. Clean Energy and Sustainability

Driven by climate urgency, public awareness, and strong government support (like the Inflation Reduction Act), clean energy and sustainability industries are expanding rapidly in 2025.

Sub-sectors Booming:

- Solar and Wind Power

- Energy Storage & Batteries

- Green Hydrogen

- Electric Vehicle Infrastructure

- Carbon Capture and Recycling Technologies

Why It’s Growing:

- Corporate ESG mandates

- Climate regulations and government tax incentives

- Falling technology costs

Major Players:

- Tesla, NextEra Energy, Plug Power, Enphase Energy

- Rising stars in green battery recycling and solar tech

Investment Note:

Clean energy ETFs are among the top-performing thematic funds in 2025.

3. Cybersecurity

As digital transformation accelerates, so do security threats. The cybersecurity industry has become a non-negotiable investment for governments, enterprises, and even small businesses.

Growth Drivers:

- Surge in ransomware attacks

- Remote work and cloud adoption vulnerabilities

- New AI-based cyberattacks

Emerging Areas:

- Zero Trust Security

- Quantum-resistant encryption

- Cybersecurity for critical infrastructure (utilities, healthcare, defense)

Top Companies:

- CrowdStrike, Palo Alto Networks, Zscaler

- Innovative startups in cyber threat prediction and prevention

Outlook:

Expected to grow at a CAGR of over 12% through 2030

4. Biotech and Precision Medicine

The intersection of biology and technology has created a medical renaissance. In 2025, the U.S. biotech and healthcare innovation sector is one of the fastest growing, particularly in personalized medicine and genetic therapies.

Driving Growth:

- Breakthroughs in gene editing (CRISPR)

- AI-powered drug discovery

- Expansion of telehealth and remote diagnostics

Innovations to Watch:

- mRNA vaccines beyond COVID (cancer, flu, autoimmune)

- Digital therapeutics and wearable health devices

- Stem cell and regenerative treatments

Leading Companies:

- Moderna, Illumina, CRISPR Therapeutics, Teladoc

- Hundreds of biotech startups in clinical trial pipelines

5. Construction Tech & Green Infrastructure

In 2025, both public and private investment is flowing into smart cities, eco-friendly buildings, and digital-first construction systems. The industry is moving toward automation, sustainability, and AI-driven project management.

Key Growth Factors:

- Government infrastructure bills

- Housing shortage and urban expansion

- Adoption of modular and prefabricated construction

Technology Trends:

- 3D-printed homes

- Drones and AI for site monitoring

- Sustainable construction materials

Top Firms:

- Caterpillar, Autodesk (for digital design tools), emerging construction robotics startups

6. EdTech and Upskilling Platforms

The education industry is undergoing massive change. Traditional learning models are being replaced or augmented by personalized, digital-first platforms.

Why It’s Booming:

- Demand for tech skills in AI, data science, blockchain, and digital marketing

- Remote learning becoming mainstream

- Corporate investment in upskilling internal talent

Growth Areas:

- AI tutors and adaptive learning platforms

- Skill-based micro-certifications

- VR/AR-based immersive learning

Key Players:

- Duolingo, Coursera, Khan Academy, Chegg

- Startups offering niche upskilling (e.g., AI bootcamps, coding, business analytics)

7. E-Commerce and Social Commerce

Despite stabilization post-pandemic, e-commerce continues to expand, thanks to the rise of social selling, influencer marketing, and AI-enhanced product discovery.

What’s Driving Growth:

- Integration with platforms like TikTok, Instagram, YouTube

- Personalized AI shopping assistants

- Mobile-first experience across platforms

Trends to Watch:

- Voice-assisted shopping

- AR/VR try-ons

- Subscription and DTC models

Growth Leaders:

- Shopify, Amazon, Etsy, Shein

- DTC startups using AI-powered recommendation engines

8. Supply Chain & Logistics Tech

The global supply chain is undergoing a major overhaul post-pandemic. Companies are investing in resilience, digitization, and last-mile efficiency, which is fueling growth in logistics technology.

Key Growth Trends:

- AI-powered inventory management

- Drone and autonomous vehicle deliveries

- Blockchain-based supply chain transparency

Major Players:

- FedEx, UPS, Flexport, Amazon Logistics

- Startups developing warehouse robotics and logistics SaaS platforms

9. Fintech & Digital Payments

Fintech is revolutionizing the way Americans manage, borrow, invest, and spend money. In 2025, this industry continues to grow—especially in embedded finance and digital banking.

Growth Areas:

- Buy Now, Pay Later (BNPL) services

- AI-powered credit scoring

- Decentralized Finance (DeFi) and crypto-backed services

- Mobile-only neobanks

Top Companies:

- SoFi, Robinhood, Chime, Square (Block), Stripe

- Fintechs targeting underserved communities and gig workers

10. Digital Entertainment & Gaming

From streaming wars to immersive gaming, the U.S. digital entertainment industry is a cultural and economic juggernaut in 2025.

Driving Growth:

- Explosion of mobile gaming

- Creator economy monetization tools

- Growth in metaverse experiences and virtual concerts/events

Innovations:

- Gaming-as-a-Service (GaaS)

- Interactive TV and storytelling

- AI-generated characters and plotlines

Industry Leaders:

- Netflix (interactive games), Epic Games, Roblox, Twitch, Unity

11. Travel and Experiential Tourism

Post-pandemic wanderlust has led to a sharp revival in travel and tourism. Consumers are prioritizing experiences over material goods, and the industry is adapting fast.

What’s Growing:

- Luxury eco-tourism

- Adventure and remote work travel

- AI-based personalized trip planning

Platforms Leading Innovation:

- Airbnb, Expedia, Booking Holdings, TripActions

- Travel tech startups providing dynamic pricing, itinerary AI assistants

Industry Growth Table (2025 Snapshot)

| Industry | Growth Catalyst | Projected CAGR (2025–2030) |

|---|---|---|

| Artificial Intelligence | Mass adoption, enterprise AI | 19–22% |

| Clean Energy | ESG policies, climate urgency | 14–18% |

| Cybersecurity | Digital threats, remote work | 12–15% |

| Biotech | Genetic medicine, AI drug discovery | 10–13% |

| EdTech | Upskilling, remote learning | 11–14% |

| Fintech | Digital banking, embedded finance | 9–12% |

| E-Commerce | Social shopping, personalization | 10–13% |

| Gaming & Digital Media | Creator economy, GaaS | 8–11% |

| Logistics Tech | Supply chain optimization | 8–10% |

| Construction Tech | Infrastructure boom, modular tech | 7–9% |

Final Thoughts: Where the Smart Money Is Headed in 2025

From AI to clean energy, biotech to e-commerce, the fastest growing U.S. industries in 2025 are reshaping how we live, work, learn, travel, and stay healthy. What separates this growth era from previous ones is the intersection of technology with essential industries—like energy, health, education, and logistics.

For Investors:

- Focus on thematic ETFs tied to emerging sectors (e.g., AIQ, ICLN, ARKG)

- Diversify across high-growth industries to manage sector-specific risks

For Entrepreneurs:

- Seek niches in booming verticals (like AI in agriculture, or cybersecurity for small businesses)

- Focus on value-adding tech integrations, not just hype

For Professionals:

- Reskill in areas like data science, AI, green engineering, and cybersecurity

- Follow companies with real innovation, not just big valuations

Stay informed. Stay ahead. Keep watching growth.

For more deep dives on market trends and investing intelligence, follow our latest blogs at WealthInStock.us.