Investors today face a familiar yet crucial question: Should you bet on dividend stocks or growth stocks? With markets rebounding, inflation cooling, and innovation reshaping industries, the choice between reliable income and explosive capital appreciation has never been more important.

In this blog, we’ll break down dividend vs. growth stocks, explore the pros and cons of each, and help you decide where to place your bets in 2025 based on your goals, risk tolerance, and the evolving U.S. market landscape.

Dividend Stocks vs. Growth Stocks: A Quick Overview

| Feature | Dividend Stocks | Growth Stocks |

|---|---|---|

| Objective | Generate steady income | Capital appreciation |

| Risk | Lower volatility | Higher volatility |

| Dividend Payout | High (3%–6%+) | Low or none |

| Suitable For | Income-seeking, conservative investors | Long-term, risk-tolerant investors |

| Sector Focus | Utilities, consumer staples, banks | Tech, biotech, disruptive sectors |

What Are Dividend Stocks?

Dividend stocks are shares of companies that return a portion of their earnings to shareholders regularly. These payments—called dividends—are typically issued quarterly and are popular with investors who want passive income and stability.

Examples of Popular U.S. Dividend Stocks:

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- Coca-Cola (KO)

- AT&T (T)

- Verizon (VZ)

- Realty Income Corp (O) – known as “The Monthly Dividend Company”

Pros of Dividend Stocks:

- Regular income stream

- Lower volatility

- Good for retirement and passive investors

- Can reinvest dividends for compounding

Cons:

- Slower capital appreciation

- Sensitive to interest rate hikes

- Dividend cuts in economic downturns

What Are Growth Stocks?

Growth stocks are shares of companies expected to grow revenue and profits faster than the market average. These companies often reinvest earnings back into operations instead of paying dividends.Examples of Popular U.S. Growth Stocks:

- Nvidia (NVDA)

- Tesla (TSLA)

- Amazon (AMZN)

- Palantir Technologies (PLTR)

- Snowflake (SNOW)

Pros of Growth Stocks:

- High potential for capital gains

- Aligned with innovation and emerging industries

- Can outperform in bullish markets

- Perfect for compounding over time

Cons:

- No dividend income

- High price volatility

- Valuation risk (overpriced stocks)

- Greater sensitivity to interest rates

Market Conditions in 2025: What Do They Favor?

To decide where to bet now, you must understand the macroeconomic environment:

1. Interest Rates Are Stabilizing

The Federal Reserve has paused its rate hikes in 2025. That’s good news for growth stocks, as high interest rates reduce the present value of future earnings.

2. Inflation is Declining

Consumer Price Index (CPI) is back below 3%, bringing investor confidence back to high-growth tech and speculative sectors.

3. Tech Innovation is Booming

AI, cloud, green energy, and biotech are driving Nasdaq to record highs. This creates fertile ground for growth stocks.

4. Dividend Stocks Are Holding Steady

Even in a rising market, defensive dividend stocks remain in demand for their reliable income, especially among retirees and institutional investors.

Who Should Invest in Dividend Stocks in 2025?

You might want to prioritize dividend-paying stocks if:

- You’re nearing or in retirement

- You want predictable cash flow

- You prefer lower-risk, established companies

- You’re building a portfolio focused on defensive sectors like utilities, consumer staples, or telecom

2025 Dividend Pick Examples:

- Procter & Gamble (PG): Reliable dividend aristocrat

- AbbVie (ABBV): High yield with pharma exposure

- Realty Income (O): Monthly payouts, strong REIT fundamentals

- Duke Energy (DUK): Utility with consistent cash flow

Who Should Invest in Growth Stocks in 2025?

Growth stocks are ideal if:

- You’re younger and have a long-term horizon

- You’re comfortable with market volatility

- You want to tap into disruptive innovation

- You’re investing in sectors like AI, EVs, cloud, or biotech

2025 Growth Pick Examples:

- Nvidia (NVDA): AI and semiconductor leader

- Palantir (PLTR): Government and enterprise AI

- Tesla (TSLA): EV, battery, and energy ecosystem innovator

- CrowdStrike (CRWD): Cybersecurity powerhouse

- Shopify (SHOP): E-commerce infrastructure

Income vs. Growth: A Blended Strategy?

You don’t have to choose either/or—many seasoned investors use a core-satellite strategy:

- Core Portfolio (60–70%): Stable dividend-paying blue chips

- Satellite Portfolio (30–40%): High-growth, high-potential stocks

This gives you:

- Steady income from dividends

- Capital growth from fast-moving companies

- Reduced overall volatility

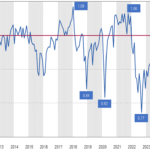

Performance Comparison: Historical Insight

| Investment Type | 10-Year Return (Annualized)* | Volatility |

|---|---|---|

| Growth Stocks (e.g., Nasdaq) | ~13–15% | High |

| Dividend Stocks (e.g., Dividend Aristocrats Index) | ~9–10% | Low to Medium |

Growth has outperformed in bull markets (2010–2021), but dividend stocks have offered better protection in volatile years (2022–2023).

What Wall Street Analysts Say in 2025

- Morgan Stanley: Favors large-cap tech growth stocks for the next 12–18 months

- Goldman Sachs: Recommends a blend of high-yield dividend payers and AI-focused growth stocks

- JPMorgan: Sees dividend stocks outperforming if recession risk resurfaces in late 2025

Final Take: Where Should You Bet Now?

Here’s a quick guide based on your investor profile:

| Investor Type | Recommendation |

|---|---|

| Young, risk-tolerant | Bet on growth stocks for capital appreciation |

| Retiree or income-seeker | Focus on dividend stocks for steady payouts |

| Balanced investor | Combine both for total return strategy |

| Cautious but growth-seeking | Look for dividend-paying growth stocks (e.g., Microsoft, Apple) |

Conclusion: It’s Not a Battle, It’s a Balance

In 2025, both dividend and growth stocks offer value—but for different reasons. The key is not just choosing the “right” stock, but the right stock for your goals.

- Want income? Go dividend.

- Want high upside? Choose growth.

- Want the best of both worlds? Blend them intelligently.

As always, do your own research, diversify, and invest for the long term. In the end, the best portfolio is the one that matches your financial needs, timeline, and risk appetite.