In today’s ever-evolving financial markets, successful investing isn’t just about chasing returns—it’s about finding the right balance between growth and stability. Whether you’re a seasoned investor or just starting out, knowing how to pursue high returns without exposing your portfolio to excessive risk is key to long-term wealth creation.

This concept lies at the heart of risk-aware investing.

In this blog, we’ll explore:

- What risk-aware investing really means

- Why balancing growth and stability matters

- How to build a portfolio with both upside and protection

- Real-world strategies to help you succeed

- Common pitfalls to avoid

What Is Risk-Aware Investing?

Risk-aware investing is an approach that emphasizes return potential while actively managing downside exposure. It’s not about avoiding risk altogether—it’s about understanding it and allocating your capital in a way that aligns with your goals, risk tolerance, and time horizon.

It requires answering critical questions like:

- What am I investing for?

- How much volatility can I stomach?

- What’s my timeline?

- What if the market drops 20% tomorrow?

Growth vs. Stability: Understanding the Trade-Off

| Strategy | Focus | Risk Level | Return Potential |

|---|---|---|---|

| Growth Investing | High-return assets (tech, small caps, innovation) | High | High |

| Stability/Income Investing | Safe assets (bonds, dividend stocks, cash equivalents) | Low | Moderate |

Key Insight:

The more you tilt toward growth, the more volatility you’re likely to face. Too much stability, and you might underperform inflation. The goal is to blend both to match your financial objectives.

Building a Balanced Portfolio: Core Principles

1. Know Your Risk Profile

Your asset allocation should reflect your:

- Age

- Investment goals

- Time horizon

- Emotional tolerance for volatility

A 25-year-old saving for retirement may lean toward growth, while a 60-year-old nearing retirement may prioritize stability.

2. Diversify Across Asset Classes

Don’t bet everything on high-growth stocks or low-yield bonds. Build a portfolio that includes:

- Equities: U.S. and international stocks

- Bonds: Government and corporate

- Real assets: REITs, commodities, gold

- Cash equivalents: Money market funds, T-bills

Diversification helps reduce the risk that any single market event will derail your entire portfolio.

3. Use the Core-Satellite Strategy

This approach creates balance by blending stability with targeted growth.

- Core: 60–80% in diversified, lower-risk holdings (index funds, large-cap ETFs, bonds)

- Satellite: 20–40% in high-growth opportunities (sector ETFs, individual stocks, emerging markets)

The core provides safety; the satellites deliver upside.

4. Monitor and Rebalance Regularly

Even a well-diversified portfolio can drift over time. Rebalancing:

- Locks in gains from outperforming assets

- Keeps your risk in check

- Aligns your portfolio with your goals

Rebalance quarterly or annually to stay disciplined.

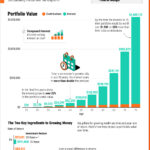

5. Invest with a Long-Term Mindset

Growth and stability don’t need to be in conflict—they can coexist if you’re thinking long term.

Market Reality:

- Markets fluctuate in the short term

- Over decades, well-balanced portfolios tend to grow with less stress

Real-World Portfolio Examples

Example 1: Young Professional (Age 30)

- Goal: Build wealth for retirement in 30+ years

- Allocation:

- 70% U.S. & international stocks

- 15% real estate (REITs)

- 10% bonds

- 5% cash

Example 2: Pre-Retiree (Age 60)

- Goal: Preserve capital and generate income

- Allocation:

- 40% large-cap & dividend stocks

- 40% bonds

- 10% REITs

- 10% cash or T-bills

Even conservative portfolios should include some growth exposure to outpace inflation.

Risk Management Techniques

| Technique | Benefit |

|---|---|

| Stop-loss orders | Prevent large individual stock losses |

| Low-cost ETFs | Broad exposure without overconcentration |

| Dividend reinvestment (DRIP) | Enhances compounding |

| Tactical asset shifts | Adjusts exposure based on macro trends |

| Downside hedging (options, gold, inverse ETFs) | Cushion against major market downturns |

Common Mistakes to Avoid

| Mistake | Consequence |

|---|---|

| Overloading on growth stocks | Sharp losses in market downturns |

| Too conservative too early | Low returns and purchasing power erosion |

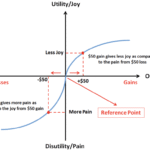

| Emotional trading | Buying high, selling low |

| Ignoring inflation | Hidden erosion of real returns |

| Lack of diversification | Overexposure to single sector risk |

Growth + Stability = Long-Term Success

Think of your portfolio like a well-built house:

- Growth stocks are the expansion—adding new rooms and value

- Stable assets are the foundation—keeping everything upright during storms

You don’t need to pick one or the other. The strongest portfolios are those that grow consistently while weathering the volatility that always comes.

Final Thoughts

Risk-aware investing is not about avoiding risk—it’s about making informed, strategic choices that help you grow your wealth without losing sleep. By balancing growth and stability, you can:

- Build wealth with confidence

- Reduce the emotional toll of market swings

- Stay focused on your long-term financial goals.