Posted inGrowth Watch

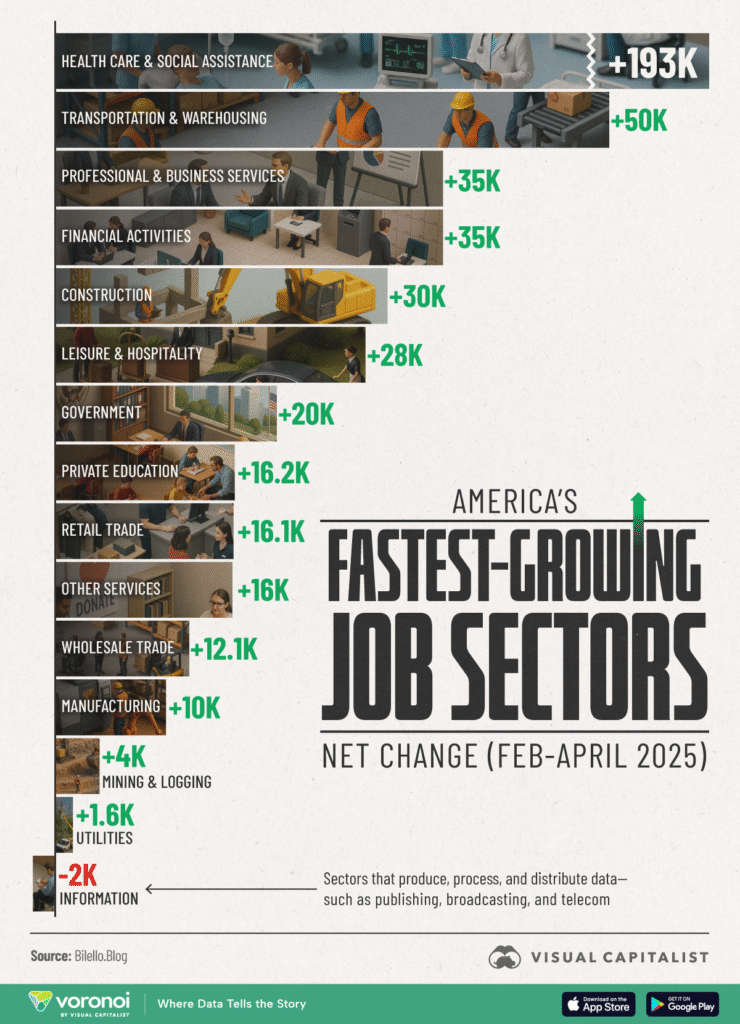

Fastest Growing U.S. Industries to Watch This Year (2025 Edition)

In 2025, the United States economy is evolving at lightning speed. Emerging technologies, shifting consumer behavior, changing government policies, and the aftermath of global disruptions have created a dynamic environment…