In an increasingly interconnected world, U.S. companies face unprecedented exposure to global market volatility. From rising interest rates and inflation shocks to geopolitical tensions and supply chain disruptions, the complexity and unpredictability of today’s economic landscape require sophisticated risk management strategies.

In 2025, as market conditions remain dynamic, managing market risk is not just a function of finance—it’s a strategic imperative. This blog explores how leading U.S. firms identify, assess, and control market risk in times of global uncertainty.

What Is Market Risk?

Market risk refers to the possibility of financial losses due to adverse movements in market variables such as interest rates, currency exchange rates, equity prices, or commodity prices. For U.S. companies, these risks are amplified by global developments that affect demand, investment, and pricing power.

Common Types of Market Risk for U.S. Companies:

| Type of Risk | Description |

|---|---|

| Interest Rate Risk | Exposure to changes in borrowing/lending rates |

| Foreign Exchange Risk | Volatility in currency exchange rates impacting imports/exports |

| Commodity Price Risk | Fluctuations in raw material or energy costs |

| Equity Market Risk | Exposure to changes in share prices and valuations |

| Geopolitical Risk | Market impact from wars, trade wars, or sanctions |

Why Is Global Volatility Increasing?

Global markets have become more sensitive due to a mix of economic, technological, and political factors. Events happening across borders now affect U.S. firms more directly than ever.

Key Global Volatility Drivers in 2025:

- Persistent inflation and tightening monetary policy by central banks

- U.S.-China trade and tech tensions

- Oil price shocks due to Middle East instability

- Rising cybersecurity threats to global infrastructure

- Shifting supply chains due to nearshoring and friend-shoring

- Climate-related disruptions affecting energy and agriculture

U.S. companies must adapt in real-time, using advanced risk frameworks and agile decision-making.

How U.S. Companies Manage Market Risk

Let’s explore how leading corporations across sectors—tech, manufacturing, retail, finance—approach market risk management in a volatile world.

1. Hedging Strategies Using Financial Derivatives

Many companies use derivatives like futures, options, and swaps to hedge market risk. This allows them to lock in prices or rates and reduce uncertainty.

Hedging Examples:

- Airlines hedge against rising jet fuel prices using oil futures

- Exporters hedge currency risk with forward contracts on foreign exchange

- Tech companies use interest rate swaps to manage bond issuance costs

Case Study:

Coca-Cola hedges foreign exchange risk in over 70 currencies to maintain consistent revenue streams globally.

Benefits:

- Predictable costs and revenues

- Protection from short-term volatility

- Better financial planning and investor confidence

Risk Control Tip: Companies must regularly reassess hedge effectiveness and avoid speculative misuse of derivatives.

2. Scenario Planning and Stress Testing

Top firms conduct stress tests and scenario analyses to prepare for extreme but plausible market events—like a recession, currency devaluation, or interest rate shock.

Scenario Planning Involves:

- Mapping out worst-case and best-case financial scenarios

- Identifying impact on revenues, supply chains, and capital costs

- Testing resilience of balance sheets under volatile conditions

Tools Used:

- Monte Carlo simulations

- Value-at-risk (VaR) models

- Economic capital modeling

Case Study:

Bank of America runs macroeconomic stress scenarios quarterly to align credit and market risk appetite.

3. Geographic and Supply Chain Diversification

Diversifying suppliers, customers, and operational hubs across regions minimizes concentration risk due to regional volatility.

Diversification Strategies:

- Building supply alternatives in Latin America and Southeast Asia

- Shifting from China-centric sourcing to “China + 1” models

- Targeting new growth markets (e.g., Africa, Eastern Europe)

- Establishing multi-region data centers and logistics networks

Example:

Apple has diversified manufacturing away from China to India and Vietnam to reduce geopolitical exposure.

4. Dynamic Pricing and Contract Adjustments

Companies exposed to commodity or currency volatility build in pricing flexibility through clauses in customer or supplier contracts.

Common Tools:

- Escalation clauses tied to oil, metals, or FX rates

- Minimum-maximum bands for price renegotiation

- Quarterly price reviews with key buyers

Example:

Car manufacturers adjust vehicle prices every quarter based on raw material index changes, passing on some costs to end users.

5. Foreign Exchange Risk Controls

For multinational U.S. firms, FX risk is a daily concern, as revenue and expenses span dozens of currencies.

FX Risk Management Tools:

- Natural hedging by matching costs and revenues in the same currency

- Forward contracts to lock in future exchange rates

- Currency options to protect downside while keeping upside potential

- Multi-currency accounts to delay conversions until favorable rates emerge

Case Study:

Microsoft reports FX-adjusted revenue and uses sophisticated hedging programs to shield earnings from dollar fluctuations.

6. Interest Rate Risk Management

With rising U.S. interest rates and yield curve shifts, companies are managing debt exposure and asset sensitivity more actively.

Tactics:

- Issuing fixed-rate bonds instead of floating-rate

- Refinancing high-cost debt when rates fall

- Using interest rate swaps to adjust exposure

- Asset-liability matching for pension funds and insurers

Example:

Real estate companies like Simon Property Group use swaps and caps to manage interest cost fluctuations on mortgages and commercial loans.

7. Use of Real-Time Risk Analytics Platforms

Technology plays a major role in identifying, quantifying, and responding to market risks. U.S. firms are investing in risk analytics tools and dashboards powered by AI and big data.

Key Tools:

- Bloomberg Terminal, FactSet, S&P Global for market data

- BlackRock Aladdin and Oracle Risk Management Cloud

- SAP Integrated Business Planning

- Tableau and Power BI for scenario visualizations

Benefit:

Dashboards enable CFOs, risk officers, and treasury teams to monitor exposures and react in near-real-time.

8. Maintaining Strategic Reserves and Capital Buffers

Financially prudent companies keep reserve liquidity and emergency credit lines to respond to unpredictable shocks.

Best Practices:

- Holding cash equivalents or short-term Treasuries

- Maintaining undrawn credit facilities

- Ensuring high credit ratings to access emergency funding

- Managing working capital cycles efficiently

Example:

Amazon held $80+ billion in cash equivalents post-pandemic to maintain supply chains and fuel investment amid market shocks.

9. Insurance and Political Risk Coverage

Companies with overseas assets often purchase specialized insurance to protect against market-related disruptions.

Insurance Types:

- Political risk insurance (expropriation, currency inconvertibility)

- Business interruption insurance (natural disasters)

- Commodity price protection contracts

- Cyber insurance (protects against data breaches & cyber market fallout)

Example:

Global manufacturing companies use Export-Import Bank of the U.S. (EXIM) coverage to insure against emerging market risks.

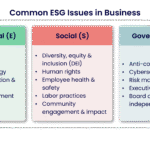

10. ESG and Climate Risk Integration

ESG (Environmental, Social, and Governance) is no longer optional—climate-related market risks like carbon pricing, regulatory shifts, and reputational impact can significantly affect valuation.

Mitigation Actions:

- Investing in renewable energy or low-emission manufacturing

- Reporting to CDP, TCFD, or ISSB frameworks

- Avoiding markets with ESG non-compliance penalties

- Building carbon offset and sustainability hedging into business models

Example:

Tesla and GM have ESG-aligned sourcing and offset programs to reduce volatility due to regulatory and reputational pressures.

Real-World Examples: How Top U.S. Companies Navigate Market Risk

Apple Inc.

- Multi-location manufacturing to manage geopolitical risk

- Hedging against yen, yuan, and euro exposure

- Dynamic pricing and FX-neutral financial reporting

Delta Airlines

- Active jet fuel hedging program using crude oil derivatives

- Flexible ticket pricing based on real-time demand forecasting

- Cash reserves and liquidity access during pandemic shocks

Procter & Gamble (P&G)

- Currency hedging in 100+ markets

- Input cost forecasting and supplier diversification

- Contingency manufacturing and logistics planning

What Small and Mid-Sized Businesses Can Learn

Even smaller firms can adopt big-company risk management practices by:

- Using cloud-based treasury and risk tools

- Establishing bank lines of credit for downturns

- Diversifying supplier and customer bases

- Hiring part-time CFO or financial consultants

- Starting with simple hedges or fixed-rate debt structures

Conclusion: Agility, Insight, and Discipline Drive Risk Resilience

Global market volatility isn’t going away—in fact, it’s becoming the new normal. But U.S. companies that embrace agile planning, adopt real-time tools, and maintain strong financial governance can turn market risk into a strategic advantage.

Whether you’re a multinational with global exposure or a regional company impacted by commodity swings or inflation, managing market risk means building the capability to navigate storms without capsizing.