1. What Is Real Estate Crowdfunding?

Real estate crowdfunding pools capital from many investors—often via online platforms—to fund property projects. These can be split into:

- Equity crowdfunding: investors own part of a project and earn returns through rental income and property appreciation.

- Debt crowdfunding: investors act as lenders, receiving scheduled interest payments secured by the real estate asset

There are also hybrid models, tokenized offerings, and fractional home ownership platforms like Pacaso, Arrived, Lofty, and Mogul that let you buy individual shares in homes or RE projects

2. Market Growth & Scale

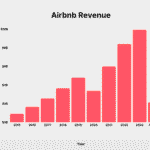

Real estate crowdfunding has grown rapidly over the past decade:

- The global market was valued at $1.5 billion in 2020, projected to reach $5.5–7.8 billion by 2025/26 .

- North America accounts for 55–65% of activity, with ~4,000–5,000 active platforms worldwide .

- As of 2023, over 300,000 global investors have contributed, with institutional participation (~15–25%) steadily rising

- Return data shows average annualized net returns of 7–10%, IRRs of 12–15%, and debt-based yields at 6–9%

While still under 5% of global real estate investment, its CAGR (~30%) suggests significant growth potential

3. Why It’s Gaining Momentum

🔹 Lower Entry Barriers

Minimum investments often start at $500–1,000—even as low as $5 on platforms like Arrived—allowing widespread participation

🔹 Diversification at Scale

Investors can spread capital across projects—residential, commercial, multifamily—reducing single-asset risk

🔹 Passive Income & Professional Oversight

Crowdfunded deals can yield monthly/quarterly distributions with paid project managers handling operations and maintenance .

🔹 Technological Enhancements

Platforms now offer AI-based investment tools, digital onboarding, blockchain-based tokenization, and secondary markets, enhancing liquidity and transparency

🔹 Alignment with ESG & Community Goals

Many platforms highlight green building and affordable housing, tapping into investor interest in socially responsible real estate .

4. Popular U.S. Platforms to Know

✅ Fundrise

Launched in 2010, Fundrise pioneered eREITs—a mix of debt & equity. It manages ~$5 billion in assets and offers diverse product lines with liquidity options via quarterly redemption windows

✅ Groundfloor

Focuses on debt crowdfunding for residential development. Since 2013, it’s funded over $70 million across ~500 loans offering ~12% annual returns on 6–12 month terms, with staking starting at $10

✅ Arrived, Lofty, Mogul

These platforms enable fractional ownership of rental homes:

- Arrived: minimum investments ~$12, aggregated across ~400 properties; returns have exceeded 70% on some holdings

- Lofty: offers tokenized home shares starting at around $50

- Mogul: focusing on short-term rental income in Sunbelt locales, with multi-digit yields .

✅ Pacaso

Helps investors buy fractional ownership in luxury secondary residences. Fractional shares start at around $200K for 1/8 of a home. It offers co-ownership and property management but caters to higher-net-worth buyers

✅ Prodigy Network & others

Platforms like Prodigy Network focus on large-scale commercial projects, often for accredited investors, with global reach—e.g., their $53 M Assemblage Park Avenue campaign

5. Performance, Fees & Liquidity

📈 Returns

- Equity projects typically yield 8–12% net annual returns

- Debt deals often offer 6–9% fixed income .

Although some Arrived properties saw 70%+ returns, others have underperformed or experienced red metrics WIRED.

📊 Fees

Platform fees vary—annual management fees average 1–3% AUM, plus deal-level fees and profit-sharing. Some platforms charge performance or exit penalties .

↔️ Liquidity

Investments are typically locked in for 3–7 years. Secondary markets are emerging—volumes have grown ~30% since 2021—but liquidity remains limited .

6. Risks You Must Consider

| Risk Factor | Description |

|---|---|

| Illiquidity | Capital is tied for years; early exits may be costly |

| Platform Risk | Platform failure or fraud (e.g., PeerStreet bankruptcy) can lead to losses . |

| Project Risk | Development delays, market downturns, tenant vacancies can erode returns . |

| Fee Drag | Multiple layers of fees can meaningfully reduce net gains . |

| Limited Control | Investors generally can’t influence property-level decisions . |

| Regulatory Risk | Changes to crowdfunding rules could impact retail investor access or fund structure . |

7. Best Practices for U.S. Investors

- Do due diligence on platform track record, fees, and project vetting.

- Diversify across deals, property types, geographies, and deal types (debt, equity).

- Match investment term to your liquidity needs—crowdfunded real estate demands patience.

- Understand your exit options and secondary market limitations.

- Read deal documents carefully, including risk disclosures and fees.

- Start small—test the waters with $500–1,000 before bigger allocations.

- Monitor platforms actively, considering legal/regulatory updates and macro trends.

8. How Crowdfunding Fits Your Portfolio

- Core allocation: Fundrise eREITs or well-diversified debt/equity offerings.

- Tactical investment: Short-term debt deals via Groundfloor.

- Niche/exposure: Fractional single-family or vacation home shares.

- Thematically targeted: ESG-driven, affordable housing, mixed-use development.

Crowdfunding allows inclusion of real estate alternatives within taxable, IRA, or 401(k) accounts (subject to platform rules).

9. The Future Outlook

- Expansion of tokenized real estate via blockchain promises more liquidity and fractional ownership transparency

- Platforms are honing AI-powered analytics, robo-advisory tools, and deeper investor dashboards .

- Institutional engagement is rising; by 2025, crowd-sourced real estate might account for ~35% of all U.S. transactions .

- ESG and community-first deals (affordable housing, renewal projects) will grow, responding to investor values .

10. ✅ Final Verdict

Real estate crowdfunding offers access, diversification, and passive income for U.S. investors—democratizing a once capital-intensive asset class.

However, it’s not without significant risks: illiquidity, platform exposure, limited control, and fee erosion. Investors should approach with care, start modestly, diversify across platforms and deal types, and treat this as a complement to core investments, not a replacement.

📌 Key Takeaways

- Crowdfunding allows individual investments from $5–$1,000, in deals historically reserved for institutions.

- Expected net returns average 7–10%, with structured options for debt or equity exposure.

- Major platforms include Fundrise, Groundfloor, Arrived, Lofty, Mogul, Pacaso, catering to different risk and capital preferences.

- Risks include platform failure, market/project misperformance, illiquidity, and fees.

- The trend is scaling fast—AUM projected to hit $7–8 billion by 2025, fueled by tokenization and institutional entry.

- For long-term investors seeking income, real estate exposure, and portfolio diversification, crowdfunding is a powerful new tool—when used thoughtfully.