1. The Case for Dividend Stocks in Today’s Market

✅ Stability Amid Market Volatility

With geopolitical tensions, tariff shocks, and overextended valuations in tech, investors are increasingly turning to dividend stocks for reliability. Funds like Schwab U.S. Dividend Equity ETF and SPDR S&P Dividend ETF have risen ~4% so far this year and outpaced indices like the S&P 500. Dividend Aristocrats returned ~3.5% too, even as high-growth stocks saw declines

✅ Growing Dividend Payouts

Although dividend growth slowed in Q2 2025, U.S. companies still boosted net indicated dividends by $44 billion over the past year, including $57.6 billion in increases, even while cuts declined sharply year-over-year

✅ Rising Adoption of Dividends in Tech & Growth

Today roughly 80% of S&P 500 companies pay dividends, including nearly 24% in the tech sector—a big shift from a decade ago Growth sectors are increasingly sharing cash with income-oriented investors.

2. Strategy Fundamentals: Building a Dividend Portfolio

🎯 Focus on Yield + Dividend Quality

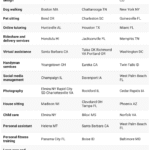

Choose firms offering 3–6% yields, strong free cash flow, and consistent payout histories. For instance:

- Consumer staples & utilities like Coca‑Cola, Procter & Gamble, NextEra Energy, Realty Income, and Enbridge offer reliable income and durable business models

- Energy midstream leaders like MPLX yield ~7.5%, backed by strong infrastructure cash flow

🏅 Dividend Growth & Aristocrats

Consider Dividend Aristocrats—companies in the S&P 500 that have raised payouts for at least 25 consecutive years. These include Johnson & Johnson, Procter & Gamble, ExxonMobil, Realty Income, and NextEra

Delta Air Lines notably raised its dividend by 25%, reflecting improving free cash flow and confidence from airline industry leaders

🧠 Diversification Across Sectors

Key defensive sectors include:

- Utilities: Lower volatility, inflation-aligned pricing.

- Consumer staples: Stable demand regardless of economic cycles.

- Healthcare & industrials: Dividend leaders like Merck and UPS continue boosting payouts (~Merck 5.2%, UPS 5.3% yield)

- Energy & telecoms: Verizon yields ~6.3%, Altria ~8%, and utility-like infrastructure firms offer consistent cash returns

🔁 Reinvesting Dividends via DRIPs

Dividend Reinvestment Plans (DRIPs) automate compounding by purchasing fractional shares with dividends. This supports dollar-cost averaging and portfolio growth without fees

3. Which Sectors & Stocks to Watch in 2025

🏭 Energy & MLPs

- ExxonMobil (XOM) and Chevron (CVX) yield ~5–8% and boast free cash flow growth capacity. Chevron raised its dividend this year, even amidst macro uncertainty, as earnings strength supports long‑term payout sustainability .

- MPLX Partners offers ~7.5% yield backed by pipeline infrastructure and fee-based income

🏢 Telecoms

- Verizon (VZ) yields ~6.6% while maintaining stable cash flows through the 5G cycle

- AT&T also features in yield leader lists around 9–10%, though payout sustainability requires careful review

🥤 Consumer Staples

- Procter & Gamble (PG), Coca‑Cola (KO), Johnson & Johnson (JNJ), PepsiCo (PEP) provide 2.5–3%+ yields with decades of reliable dividend increases

🚛 Industrials & Logistics

- UPS offers ~5.3% yield and recently raised dividend, positioning for earnings recovery in 2025, especially in healthcare logistics and SMB services

🧪 Reinvestment Candidates with Growth Potential

- Healthcare giants like Merck (MRK) and defense/industrial names like 3M (MMM) offer yields >3% & dividend growth history, though with some valuation constraints .

4. Risks to Manage in a Dividend Income Strategy

⚠️ Economic & Rate Environment

Interest rates remain elevated; bond yields at ~4–5% can compete with equity dividends. Investors rightly expect payouts to keep pace or risk capital flight to fixed income .

Dividend growth has slowed—Q2 2025 saw a 50% decline in increases from prior periods, driven by caution around tariffs and sales uncertainty

⚠️ Dividend Cuts and Sustainability

While cuts have declined by ~45% from 2024, they still occur. Careful attention to payout ratios and sector vulnerability (e.g., retail, cyclical sectors) is vital

⚠️ Valuation & Sector Concentration

High-yield and utility-heavy portfolios may risk overconcentration. Analysts caution about overvaluation in defensive sectors even as they highlight dividend stock resilience amid market churn .

5. Building a 2025 Passive Income Portfolio: Blueprint

🧱 Step 1: Develop Core-Satellite Allocation

Core holdings (60–70%)

- Dividend Aristocrats ETFs or stable large-caps: JNJ, PG, KO, NEE, Realty Income.

Satellite picks (30–40%)

- High-yield MLPs or telecoms: MPLX, Verizon, Altria.

- Growth-aligned names raising payouts: Delta, UPS, Merck.

⏳ Step 2: Automate via DRIPs

Enable quarterly reinvestment; aggregate dividends tax-efficiently; compound over time.

💡 Step 3: Monitor Metrics Regularly

Track payout ratios, cash flow support, debt levels, industry trends, and dividend raise history.

🌱 Step 4: Consider ESG & Sustainability Themes

Sustainable dividend stocks (especially in energy infrastructure or consumer sectors) may enjoy stronger long-term resilience and investor preference

📊 Step 5: Use ETFs for Diversification

Dividend dividend-focused ETFs such as Vanguard Dividend Appreciation ETF or S&P Dividend Aristocrats ETF offer broad exposure and low cost

6. Compound Growth in Action: Modeling Outcomes

Consider an investor starting with $100,000 and targeting 4% yield ($4,000/year). Reinvesting dividends via DRIPs, even flat yield with modest 2% annual raise, yields:

| Year | Portfolio Value (incl. reinvestment) |

|---|---|

| 5 | ~$122k |

| 10 | ~$150k |

| 20 | ~$215k |

This mirrors how dividend growth + compounding can outpace inflation and fixed income returns over 10–20 years.

7. Key Takeaways for U.S. Investors in 2025

- Dividend stocks offer stability, income, and potential for income growth, particularly in volatile or overvalued equity markets.

- Energy, telecoms, consumer staples, utilities, and industrials provide durable yields today—2.5–7.5%+.

- Dividend growth is moderate but still occurring. S&P‑wide increases slowed recently due to macro uncertainty, but companies like Wilmington, JPMorgan, and Delta are lifting payouts aggressively .

- DRIPs and ETF strategies offer scalable, low-cost ways to compound income automatically.

- Risks include interest-rate competition, dividend cuts, and sector concentration. Diversification and monitoring payout fundamentals are essential.

- ESG-aligned dividend stocks and thematic ETFs are growing in appeal and may add resilience in turbulent markets.

✅ Summary

U.S. dividend stocks remain a core strategy for building passive income in 2025. With market turbulence, macro uncertainty, and low equity valuations in growth sectors, dividends provide income, downside cushioning, and inflation resilience.