High-growth investment strategies are designed to deliver outsized returns—but they come with a higher level of risk. Whether you’re investing in tech startups, emerging markets, or innovative sectors like AI, biotech, or fintech, understanding how to manage risk is crucial to long-term success.

In this blog, we’ll explore:

- What defines a high-growth investment strategy

- The types of risks involved

- Core principles of risk management

- Tactical strategies to protect your portfolio

- Why risk control is critical for compounding wealth

What Are High-Growth Investment Strategies?

High-growth investing focuses on assets that have above-average potential to expand revenues, earnings, and market value, often at the cost of near-term stability.

Common High-Growth Targets:

- Technology startups

- Small-cap and mid-cap stocks

- Emerging markets

- Cryptocurrencies

- Disruptive sectors (e.g., AI, EVs, biotech)

While these investments can generate significant alpha (excess return above the market), they often experience high volatility, limited liquidity, and unpredictable performance.

Key Risks in High-Growth Investing

1. Market Volatility

High-growth stocks are more sensitive to market cycles, interest rate changes, and investor sentiment. A 10–30% price swing in a short period is not uncommon.

2. Valuation Risk

Growth stocks often trade at high price-to-earnings (P/E) ratios, making them vulnerable if earnings don’t meet expectations.

3. Execution Risk

Companies in the growth phase may not have proven business models. They face hurdles in scaling, managing cash flows, or fending off competitors.

4. Liquidity Risk

Smaller companies or alternative assets may have fewer buyers and sellers. Exiting a position during a market downturn can be costly.

5. Regulatory Risk

Innovative sectors (e.g., crypto, fintech, health tech) may be subject to evolving laws and regulations, which can quickly affect valuations.

Principles of Risk Management in High-Growth Investing

1. Diversification is Non-Negotiable

Don’t put all your capital in a few high-flyers. Spread your exposure across:

- Different sectors

- Various asset classes (equities, ETFs, real assets)

- Global markets

Diversification reduces the chance that one failure will destroy your portfolio.

2. Position Sizing Matters

Limit the weight of any single high-growth investment to a predetermined percentage of your portfolio.

Rule of thumb: No more than 5–10% in a single speculative position.

3. Use Stop-Loss and Trailing Stop Orders

Protect gains and limit losses by setting automatic triggers to sell when a stock drops a certain percentage.

- Stop-loss order: Sell if the price falls to a fixed point.

- Trailing stop: Adjusts dynamically as the stock rises.

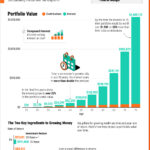

4. Implement a Core-Satellite Strategy

Use a solid core of diversified, lower-risk investments (e.g., index funds, dividend stocks) to anchor your portfolio.

Around that core, place higher-risk “satellite” investments in high-growth opportunities.

This balances upside potential with downside protection.

5. Rebalance Regularly

Review and adjust your portfolio quarterly or annually to:

- Lock in gains

- Reallocate from overweight positions

- Reassess risk based on market conditions

6. Focus on Fundamentals

Avoid hype-based investing. Instead, assess companies based on:

- Revenue growth trends

- Cash flow projections

- Total addressable market (TAM)

- Competitive advantages

A good story isn’t enough—look for real, scalable value.

7. Manage Emotional Risk

High-growth investing is emotionally challenging. FOMO (fear of missing out) and panic-selling can sabotage your long-term performance.

- Stay disciplined

- Have a plan for every trade

- Avoid chasing “hot” stocks without research

Tools and Strategies for Advanced Risk Control

| Strategy | Purpose |

|---|---|

| Hedging with Options | Use puts to protect downside or collars to limit volatility |

| Dollar-Cost Averaging (DCA) | Smooths entry points into volatile stocks |

| Risk Metrics (Sharpe, Beta, Std. Dev.) | Evaluate the risk-return tradeoff quantitatively |

| Fundamental Screening Tools | Identify high-quality growth stocks with risk filters |

High-Growth Investing in 2025: What’s Different?

In 2025, the investing landscape has evolved:

- Interest rates remain elevated, impacting valuations of high-growth stocks.

- AI and green tech are seeing massive capital inflows—but also regulatory scrutiny.

- Retail participation is high, making sentiment swings more extreme.

Key Takeaway:

High-growth opportunities are abundant—but so is risk. A cautious, well-structured approach is more important than ever.

What Happens Without Risk Management?

| Scenario | Risk |

|---|---|

| Overexposure to one sector (e.g., tech) | Massive losses in downturns |

| Ignoring stop-losses | Letting small losses grow into portfolio ruin |

| Emotional trading | Buying high, selling low—repeating the cycle |

| Overleveraging | Amplifying losses beyond recovery |

Final Thoughts

High-growth investing can supercharge your portfolio—but only if you’re prepared for the ride.

Risk is not the enemy—unmanaged risk is.

With a thoughtful strategy, defined rules, and disciplined execution, you can pursue high returns without compromising your long-term financial security.

At WealthinStock.us, we empower investors to embrace innovation while staying grounded in risk-aware strategies. Whether you’re building a growth portfolio or just starting your investment journey, we’re here to guide you every step of the way.