As the U.S. stock market continues its 2025 rally, investors are asking a critical question:

Are we in bubble territory, or is this just the beginning of a new bull market cycle?

After a volatile few years filled with inflation shocks, interest rate hikes, tech rebounds, and AI euphoria, Wall Street is split. On one side are those warning of overvaluation—pointing to high P/E ratios and speculative activity. On the other are the growth optimists, fueled by strong earnings, innovation, and macroeconomic resilience.

In this blog, we’ll dive into both sides of the argument, explore valuation metrics, sector dynamics, and economic indicators to answer:

Is the U.S. stock market overvalued—or poised for more growth?

The Current State of the Market in Mid-2025

As of July 2025:

- S&P 500 has surpassed 5,400, setting new all-time highs.

- Nasdaq-100 is booming, led by AI, semiconductor, and cloud stocks.

- Dow Jones Industrial Average is more stable, reflecting traditional sectors.

Key Market Drivers:

- Cooling inflation (now under 3%)

- The Fed pausing rate hikes

- Surging corporate earnings in big tech

- AI-led productivity gains across sectors

- Robust consumer spending and job market

So, is this justified optimism—or inflated exuberance?

Argument 1: Yes, the Market Is Overvalued

Let’s start with the bear case. Critics argue that valuations have outpaced fundamentals. Here’s why:

1. Price-to-Earnings (P/E) Ratios Are Historically High

The S&P 500 P/E ratio is currently around 25–27, well above the long-term average of ~16–18.

- Tech sector P/E is even higher, with some companies trading at 40–50x forward earnings.

- Even some non-tech growth stocks are stretching past reasonable multiples.

2. AI Mania Mirrors Dot-Com Bubble Behavior

- Nvidia (NVDA), Microsoft (MSFT), and others have seen multi-trillion dollar valuations driven by AI hype.

- Investors are pricing in decades of future growth now—raising the risk of disappointment if those expectations aren’t met.

3. Retail Investors Are Back in Force

- Increased activity on platforms like Robinhood and Reddit stocks (e.g., GameStop) have re-emerged.

- Memes, YOLO trades, and leveraged ETFs suggest speculative behavior, often seen at market tops.

4. Corporate Earnings Growth May Slow

While Q1 and Q2 earnings have been strong, many companies face:

- Shrinking margins from wage growth

- Slower overseas demand (especially in China/EU)

- Reinvestment costs for AI infrastructure

5. Global Risks Are Underpriced

- Geopolitical tensions (Taiwan, Ukraine, Middle East)

- Potential for another energy shock

- Climate-related events affecting agriculture and supply chains

Argument 2: No, the Market Is Poised for More Growth

Now, let’s look at the bull case—the reasons many believe the market is in a new growth cycle, not a bubble.

1. Real Interest Rates Are Falling

- The Fed has likely ended its rate hike cycle.

- Rate cuts may begin in early 2026, lowering the discount rate and boosting valuations.

This makes equities more attractive than bonds and cash.

2. AI-Led Productivity Gains Are Real

- Companies across industries—from finance to agriculture—are using AI to cut costs and drive efficiency.

- This could supercharge profit margins for the next 5–10 years.

Example: JPMorgan saved $1B in operational costs in 2025 due to AI automation.

3. Corporate Earnings Are Beating Expectations

- Q1 & Q2 2025 earnings season showed 8–10% YoY growth for the S&P 500.

- Big Tech firms like Apple, Amazon, Meta, and Nvidia are expanding revenues while maintaining strong free cash flow.

4. Cash is Flowing Into Equities

- Retail and institutional investors are rotating back into stocks from money market funds.

- Sovereign Wealth Funds and pension funds are increasing allocations to U.S. equities due to stability and innovation.

5. U.S. Economy Remains Resilient

- Job growth remains strong (unemployment at ~3.7%)

- Consumer confidence has rebounded

- Industrial production is up, especially in semiconductors and green energy

Breaking It Down by Sector

Let’s compare valuation vs. growth potential in major market sectors:

| Sector | Valuation Outlook | Growth Potential |

|---|---|---|

| Technology | High P/E but high innovation | Very High |

| Healthcare | Fairly valued | Strong (driven by biotech & GLP-1 drugs) |

| Financials | Modestly priced | Stable to moderate growth |

| Energy | Undervalued in some areas | Moderate, especially clean energy |

| Consumer Discretionary | Mixed | High in luxury, e-commerce, EVs |

| Utilities/REITs | Income-focused | Low to moderate growth |

Valuation Metrics to Watch in 2025

To understand where the market is headed, focus on these:

1. Forward P/E Ratios

Used to project earnings-based valuation. Look for:

- S&P 500: ~18–20 is healthy

- Tech stocks: >30 requires very strong growth

2. PEG Ratio (Price/Earnings to Growth)

- PEG < 1 = undervalued

- PEG > 2 = overvalued unless growth is exceptional

3. Price-to-Sales (P/S) Ratio

For early-stage or non-profitable companies, this is more useful. Anything above 10 is considered rich.

4. Enterprise Value / EBITDA

Often used for industrials, energy, and mature sectors.

Expert Opinions in 2025

- Goldman Sachs: Sees further upside in AI-driven stocks but urges caution in speculative small caps.

- Morgan Stanley: Market fairly valued if earnings growth continues. Recommends overweighting quality growth names.

- JP Morgan: Believes equities will outperform bonds in the next 12 months but warns of over-concentration in tech.

So, Is the Market Overvalued or Growing for Real?

Short Answer: It depends.

- If you’re a short-term trader, high valuations may signal caution, especially in overhyped sectors.

- If you’re a long-term investor, many sectors—especially AI, green tech, and biotech—still offer strong runway.

How Should You Invest in 2025?

Conservative Approach:

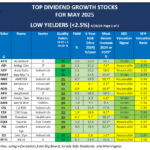

- Focus on dividend growth stocks

- Include defensive sectors like healthcare and consumer staples

- Add ETFs like VYM (High Dividend), SCHD, or VIG

Balanced Growth Approach:

- Mix large-cap growth (MSFT, NVDA) with income stocks

- Consider ETFs like QQQ, SPYG, or ARKK

Aggressive Growth Approach:

- Focus on high-conviction plays in AI, biotech, fintech

- Watch IPOs and small caps but limit exposure

🏁 Final Thoughts: Bet or Bubble?

The U.S. stock market in 2025 is not universally overvalued—but pockets of speculation exist. At the same time, innovation and earnings growth are real and measurable, especially in AI, clean energy, and semiconductors.

🔹 Be cautious of hype but don’t miss structural trends.

🔹 Valuation matters—but so does future growth.

🔹 Diversification is key—spread across value, growth, and dividends.

Conclusion:

The market may not be cheap, but it’s not irrational either. With selective investing, smart risk management, and a long-term view, investors can still find opportunities amid the noise.